World Economy Review and Prospects 2022-2023

作者: Zhang Yuyan, Xu Xiujun

After a sharp rebound from a deep recession in 2021, the world economy experienced a marked shortage in growth impetus in 2022. The growth rates fell sharply, accompanied by huge inflationary pressures, high debt levels and increasingly volatile financial markets. Currently, protectionism is still prevalent, international sanctions are escalating, international trade and investment growth faces greater constraints, and world economic recovery is more fragile.

Review of the World Economy in 2022

I. Downward pressure on the economy continues to mount

Since 2022, downward pressure on the world economy has intensified due to the protracted and recurring COVID-19 pandemic and escalating geopolitical conflicts, and international institutions have frequently lowered economic growth forecasts. In October 2022, the IMF estimated that the world economy would grow 3.2 percent in 2022, down 2.8 percentage points from 2021. International organizations such as the World Bank and the Organization for Economic Cooperation and Development have also repeatedly lowered their expectations for world economic growth in 2022. According to IMF estimates, the economic growth rate of advanced economies in 2022 would be 2.4%, down 2.8 percentage points from 2021. Emerging markets and developing economies would grow 3.7%, down 2.9 percentage points from 2021. The final estimate of world economic growth in 2022 is likely to be below 3.2%, and a further adjustment to below 3% cannot be ruled out.

II. Employment is generally improving but inflation is high

In 2022, the global job market maintained a positive recovery trend, with the overall unemployment rate in decline. In January 2022, the International Labor Organization reported that the global labor market recovery in 2022 was continuing, but uncertainties were still around. It was estimated that the global unemployment rate in 2022 would be 5.9%, down 0.3 percentage points from 2021, but still 0.5 percentage points higher than in 2019. According to the US Labor Department, the seasonally adjusted unemployment rate was 3.5% in September 2022, back to its lowest level in more than 50 years. According to Eurostat, the unemployment rate in the euro zone stood at 6.6% in July 2022, the lowest level since Eurostat began publishing the index in April 1998. However, the employment situation in low-income countries remains dire, with the unemployment rate projected at 6.0 percent in 2022, 0.1 percentage point higher than in 2021.

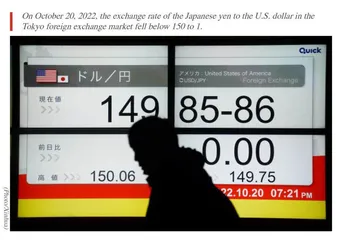

Due to COVID-19 and the crisis in Ukraine, global inflation has continued to rise. The IMF estimates that the global average inflation rate for the whole year will be 8.8% in 2022, up 4.0 percentage points from 2021. According to the US Bureau of Labor, the US core consumer price index, which excludes food and energy prices, rose by 6.6% in September 2022 from a year earlier, the highest since August 1982. Japan’s core CPI excluding fresh food rose by 3.6 percent year on year in October 2022, the highest since February 1982, data from the Ministry of Internal Affairs and Communications showed. The IMF estimates that inflation in emerging markets and developing economies will be at 9.9% in 2022, up 4.0 percentage points from 2021 and making it the highest record since 2000.

III. Global debt levels remain high

While global debt has decreased, it still runs at high levels. The IMF estimates that the ratio of gross government debt to GDP for developed economies in 2022 will be 112.4%, down 5.5 percentage points compared with 2021. Among them, the ratio for the US and the euro zone will be 122.1% and 93.0% respectively, down 6.0 and 2.3 percentage points compared with 2021. Japan’s gross government debt is 263.9% of GDP, up 1.4 percentage points from 2021. Over the same period, the total government debt of emerging markets and developing economies was 64.5 percent of GDP, up 0.8 percentage points from 2021, with China rising by 5.4 percentage points to 76.9 percent, Brazil falling by 4.8 percentage points to 88.2 percent and India falling 0.8 percentage points to 83.4 percent.

IV. Insufficient impetus for international trade and cross-border investment

International trade growth slowed sharply in 2022 after a strong rebound in 2021 due to sluggish global real demand. In October 2022, the World Trade Organization predicted that the volume of international trade in goods would grow by 3.5% in 2022, down 6.2 percentage points from 2021. In terms of cross-border investment, the growth of global FDI in 2022 not only failed to maintain the strong momentum of the previous year, but even gradually showed a downward trend due to the declining investment willingness driven by multiple factors. According to the UNCTAD report in October 2022, the total FDI in the second quarter of 2022 was $357 billion, down 31% from the first quarter and 7% from the 2021 quarterly average. Global FDI in 2022 is expected to decline and remain flat from the previous year at best.